Understanding Compound Interest in Investments

Compound interest is one of the most basic ideas about money. It could be advantageous in accumulating wealth. It is the missing link, which, if well understood and implemented, can transform small savings into huge fortunes.

What is Compound Interest?

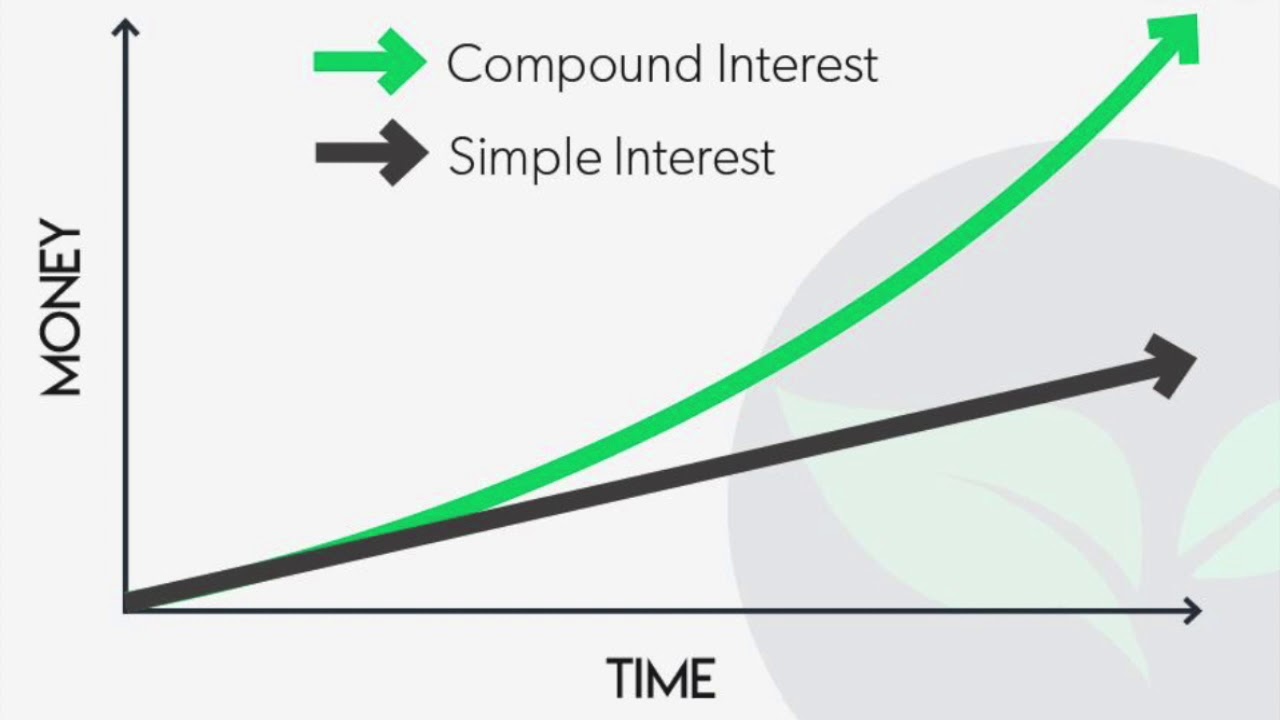

Compound interest is also referred to as interest on interest, which implies that the interest earned will act as the principal amount. Instead of only computing interest on the principal amount, it is calculated on this new amount. Conversely, compound interest is determined by the initial amount, the interest, and the interest earned. On the other hand, simple interest is calculated using the principal amount invested. This causes it to increase exponentially, where if you have made a long, long torment, you get faster returns.

How Compound Interest Works

To explain, let’s say you want to deposit one thousand dollars, and the interest is 5% compounded yearly. Thus, you will receive $50 of interest at the end of the first year, and your balance will reach $1,050. In the second year, interest of 5% would be charged on $1,050, not only $1,000, and hence $1,102 is added. 50. It goes on like this year in, year out, and instead of adding up to the principle, the interest earned forms part of the amount that you will be invested, meaning your money will grow at an increasing rate.

The Power of Time

This is one of the benefits of compound interest because time is critical to realizing these benefits. This means that the longer a person lets their money remain invested, the more returns are gotten from compounding. They say it does not matter how much the money is as long as it starts growing because even the smallest amount can increase if neglected. For instance, if you put $1000 into a business, compound interest 5% annually, without any further additions, it will be more than $1,600 in 10 years, over $2,600 in 20 years, and over $4,300 in 30 years.

The Rule of 72

The Rule of 72 is an elementary tool employed for calculating the period within which the investment returns a compound interest doubles. The calculation rule divides the fixed number 72 by your annual interest rate. For instance, if you have been generating 6% on your investment, it will take about 12 years for your money to be doubled investment (72/6). This Rule dramatically helps by considering the possibility of earning high investment returns.

Compound Interest and Inflation

Compound interest, however, helps grow the amount of money invested more than ordinary interest, with added cautionary factors such as inflation taking away the value of money over some time. All Investments carry the risk of inflation or the failure of the investment’s growth to beat the inflation rate. To guard against this, try to invest in items that will give you returns that are more than the inflation rate, for instance, in stocks or real estate.

Maximizing Compound Interest

In this case, it is recommended that one begin the process of investing as soon as possible to capitalize on compound interest. It means that the more you begin to invest early, the higher your chances of the money you invested to make time go up. Continuity is also essential; more frequent, modest deposits can positively impact the investment instrument growth rate. Also, what you earn or receive, such as dividends, should be reinvested to make your investment grow at the highest rate possible.

The Impact of Compounding Frequency

Another factor that influences the growth rate of your investment is the number of times that interest is compounded. Interest may be compounded yearly, half-yearly, quarterly, monthly, or even daily. Whenever interest is compounded more in time, the investment will be faster in earning capacity. For instance, an investment at 5% annual interest compounded quarterly will earn more than an investment compounded annually, even when both bear the same interest rate.

Conclusion

Compound interest is one of the most effective means to facilitate the growth of the invested sum of money. Worryingly, this tool is incredibly influential in shaping your finances; therefore, the more you know how to use it, the better your financial situation will be. Thus, it is possible to highlight that to earn more money using the principle of compound interest activity, it is essential to start in advance, constantly add cash to investments, and select the investments with the most frequent compounding. In the long run, it will assist the portfolio holder in achieving their financially related objectives and accumulate a sizeable wealth.

(Writer:Matti)