Investing in Emerging Markets: Pros and Cons

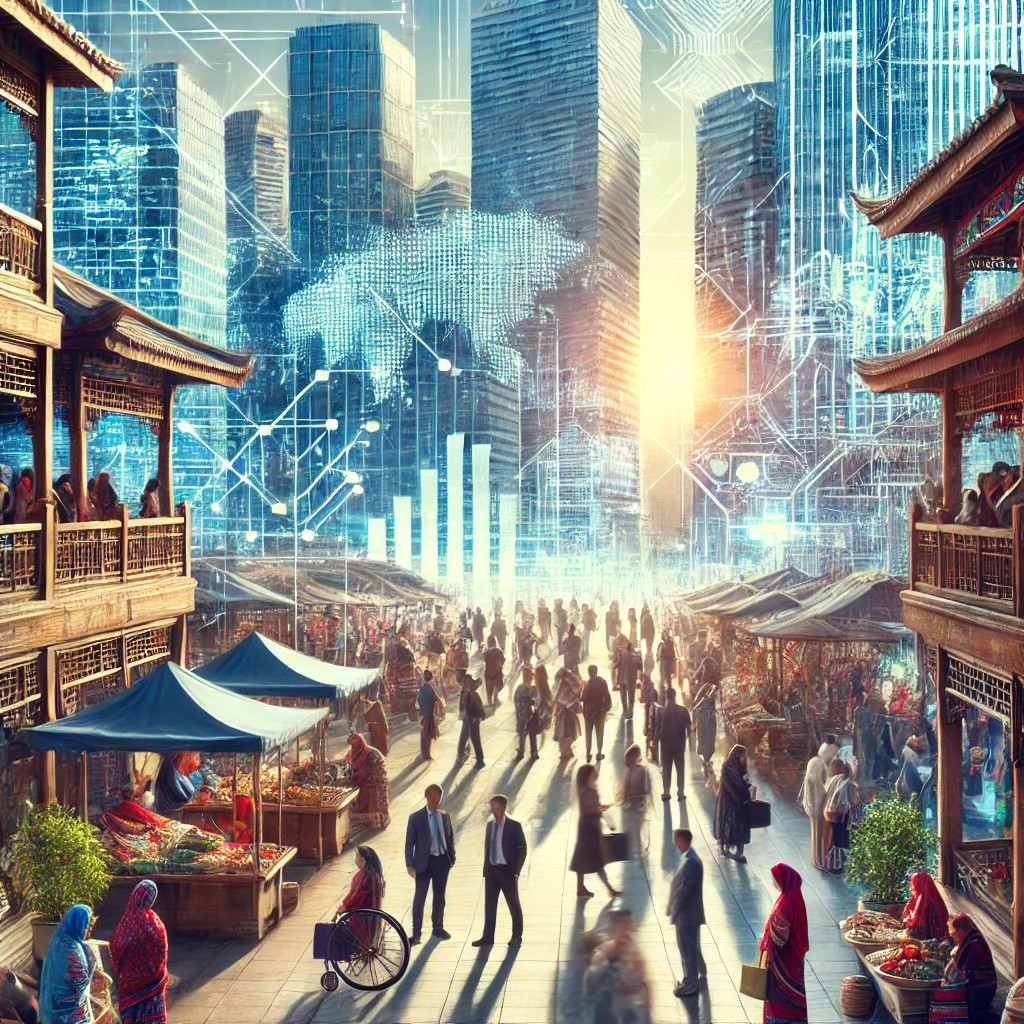

Emerging markets offer unique opportunities and challenges for investors seeking to diversify their portfolios and tap into new growth areas. As economies in Asia, Africa, Latin America, and Eastern Europe continue to develop, they present a dynamic landscape for investment. This article examines the pros and cons of investing in emerging markets, explores current trends, and speculates on future developments.

Pros of Investing in Emerging Markets

High Growth Potential: Emerging markets often experience faster economic growth compared to developed markets due to lower starting bases, rapid industrialization, and increasing consumer populations. This growth can translate into high returns for investors who enter these markets at the right time.

Diversification: By investing in emerging markets, investors can diversify their portfolios beyond mature economies, which may offer lower growth prospects. This diversification can potentially reduce overall portfolio risk and increase returns.

Demographic Advantages: Many emerging markets have young, growing populations. This demographic trend is favorable for long-term economic growth as it implies a rising workforce and increasing domestic consumption.

Cons of Investing in Emerging Markets

Political Risk: Emerging markets often face higher political instability, which can include risks from autocratic governance, corruption, and regional conflicts. Such environments can lead to sudden and unpredictable changes in investment conditions.

Market Volatility: Financial markets in emerging economies are typically less mature and more volatile. They can be heavily affected by both domestic and international economic changes, leading to greater price swings and investment risks.

Current Trends in Emerging Market Investments

Technological Leapfrogging: Many emerging markets are skipping traditional development stages by adopting new technologies. For example, mobile banking has become more widespread in Africa before traditional banking infrastructure was fully established. Such leapfrogging can create significant opportunities for growth and investment.

Increased Foreign Direct Investment (FDI): As confidence in emerging markets grows, they are attracting more FDI, which helps improve their economic infrastructure and financial systems, making these markets more accessible and less risky for foreign investors.

Improving Governance and Transparency: Many governments in emerging markets are working to improve their global integration. Efforts to enhance governance, reduce corruption, and increase transparency are making these markets more attractive to international investors.

Future Predictions for Emerging Markets

Greater Integration into Global Economy: Emerging markets are expected to become more integrated into the global economy. This integration will likely be driven by increased trade agreements, multinational business expansions, and technological advancements.

Sustainability Focus: Future investments in emerging markets will likely emphasize sustainability. Investors are increasingly considering environmental, social, and governance (ESG) factors in their investment decisions, which will influence the types of projects and companies that attract funding.

Conclusion

While investing in emerging markets offers attractive growth potential and the benefit of diversification, it also comes with increased risks of political instability and market volatility. Successful investment in these markets requires a thorough understanding of both the opportunities and the challenges. As global dynamics evolve, staying informed and responsive to changes in emerging markets will be key to maximizing investment outcomes.

(Writer:Weink)